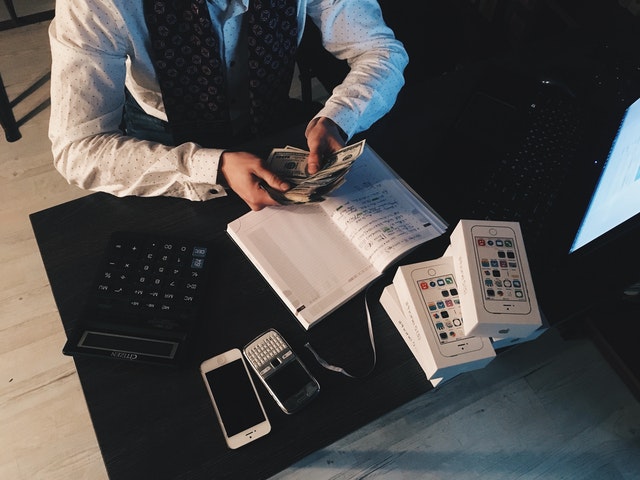

Six Smart Money Moves to Make Before December Ends

Making the right money moves at year’s end can help you start 2022 with a strong financial foundation. Consider these strategies now for peace of mind as the ball drops at midnight on New Year’s Eve.

Look at Your Budget

How have your income and expenses changed this year? Are you making the most of your money, or are you in danger of taking on more debt than you can afford? Asking these questions during a comprehensive budget review can help you trim unnecessary expenses and accelerate savings for your short-term and long-term goals.

Calculate where your money actually went in 2021 and make changes if necessary to allocate your 2022 income appropriately. The more of your income you keep, the better your overall financial position. Be especially aware of recurring charges that can be a big drain on your budget, such as subscriptions and memberships you no longer use.

Review Your Portfolio

Check in with your retirement plans and other accounts to make sure your investment choices still align with your overall financial objectives. You may need to adjust your blend of stocks, bonds and other vehicles to balance growth with risk in your preferred ratio. Talk to a financial advisor if you aren’t sure where to start.

[insert page='Offer' display='content']

Maximize Retirement contributions

If you have cash to spare after holiday shopping, put it toward your retirement if you haven’t yet reached your maximum tax-advantaged 2021 contributions. You can put up to $64,500 toward your 401(k) and reduce your taxable income, but you must make the transfer before midnight on December 31, 2021. If you're 50 or older, you can add another $6,500 as a catch-up contribution.

You also have until April 15, 2022, to max out your IRA contributions for 2021. You can put up to $6,000 in a traditional or Roth IRA, $7,000 if you’re older than 50.

Consider Charitable Giving

Holiday giving is one of my favorite family traditions. If you also tend to contribute to your charities of choice around this time of year, make sure to choose certified nonprofit organizations to receive your generosity so you can deduct your charitable contributions.

Even if you plan to itemize your 2021 tax return, you can deduct up to $300 in nonprofit gifts as a single taxpayer and $600 if you file jointly with your spouse.

Make Medical Appointments

Do you have health care coverage with a deductible or out-of-pocket maximum? If so, see how close you are to this threshold for 2021. When you meet or exceed your maximum or deductible, your plan should cover the total amount of eligible health care visits. In this case, make those primary and specialty care visits you’ve been putting off so that you don't have to pay cash for them next year when your plan resets.

You might also have a flexible spending account (FSA) through your employer. These funds expire at the end of the year, so use them for qualified health expenses such as over-the-counter medications and doctor copayments. Double-check your plan's rules, as some companies let you carry over a portion of unused funds into the new year.

Start or Replenish Your Emergency Fund

Most financial experts recommend having at least three months of expenses in a savings account to create a cushion for the unexpected. If you aren't there yet, now's a great time to create an automatic transfer from your checking account to savings. Even if you can only squirrel away a few dollars a month, this set-it-and-forget-it approach makes it surprisingly easy to prepare for a rainy day.

With these six tips, you're setting the stage to make 2022 the best money year you've ever had.