Understanding Bull and Bear Markets

The world of finance is complex, and it only becomes more intricate as you delve into asset allocation and investments. People find themselves confused by financial jargon, which muddies their understanding of financial vehicles and opportunities.

The stock market is a primary tool for building and managing wealth. Two terms used frequently to describe the market are also two of the least understood: bull and bear markets.

The terms themselves are not challenging to understand — a bull market represents an increase in market trends, and a bear market represents a decline — but as with all things, there is more to market definitions than a simple "good" or "bad" description. To grasp the concept of market trends, investors must understand the terminology beyond surface definitions.

Understanding the Bull Market

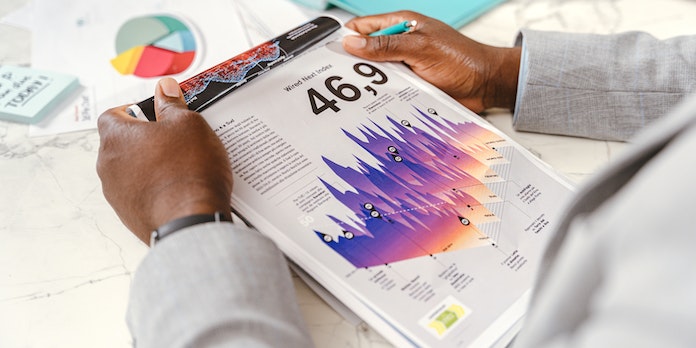

Bull markets are more than an upward trend in stock prices. For the classification of a bull market, commodities, stocks, and bonds must show rising investment prices for a sustained period. Several good indicators typically follow an upward trend in the market, such as low unemployment, high levels of consumer confidence, and eager investors.

The average bull market lasts about 3.8 years, with the longest lasting almost 10 years, from 2009 to 2019. While every investor would love to see a bull market last forever, they mainly occur on a rotating schedule, cycling from bull to bear and back.

Understanding the Bear Market

Unlike optimistic bull markets, bear markets make consumers and investors nervous. A true bear market occurs when stock prices fall by over 20% for a sustained period. The average bear market lasts about 289 days.

Bull markets thrive because of consumer confidence. Unfortunately, bear markets occur during economic slowdowns when consumer faith in the economy wavers. During economic downturns, unemployment numbers increase, supply chains weaken, and investors lose trust in the market.

Investing During Bull and Bear Markets

All experienced investors know markets are in constant flux. Many times, the gains and losses or upward and downward trends are not part of a genuine bull or bear market; they are merely consequences of a healthy economy.

As an investor, you will take on risks, regardless of market conditions. A bull market does not mean all investments will earn you good money, nor does a bear market mean they will all lose money. The key to investing is knowing how to invest during market upturns and downturns and learning to balance your portfolio to protect your finances.

In a bull market, a higher allocation of stocks offers a greater chance of returns than fixed-income securities; for a bear market, do the opposite. Regardless of the market swing, it is crucial that you avoid making emotional decisions.

Because emotions often lead to irrational investment decisions, financial advisors recommend developing a long-term strategy. Predicting bull and bear markets or market upswings and downswings is near-impossible, even for seasoned investors. By developing and sticking to a long-term portfolio strategy, you are more likely to experience investment success.

The world of finance contains many rules and much jargon. If you are inexperienced with investment strategy, it is best to work with a financial advisor, preferably a fiduciary.